Now that Samsung Electronics shares are on the rise,

Let's look at the attraction of Samsung Electronics as a dividend shareholder.

How big is Samsung Electronics?

Samsung Electronics is the representative stock of South Korea.

In the Korean Stock market, which recently surpassed 2,000 trillion won, Samsung Electronics boasts a market cap of 430 trillion won as a single stock.

Now that I'm writing, Samsung Electronics is going up to 82,200 won.

It's more than 3.6 million won before the 50:1 face split. It's been rising about 70% since the face split.

In Korea, there are many stingy sompanies in dicidends.

In the case of a foreign company, it is natural for the shareholder to pay the profits because it is the owner of the company, but it is not yet the case in Korea.

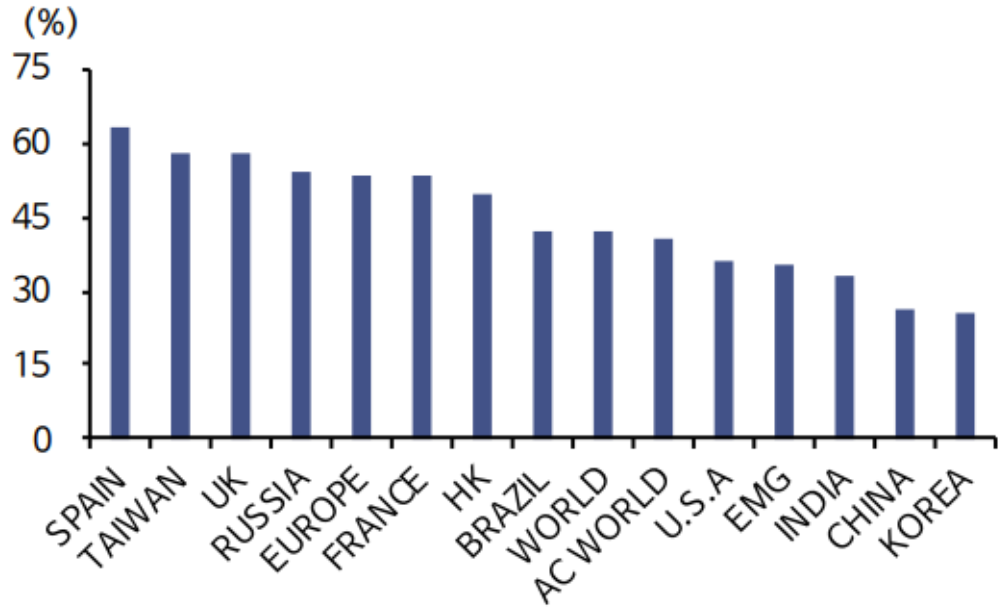

The average dicidend propensity of Korean companiese is 26%, far lower than the global average of 41%

However, the dividends of KOSPI 200 companiese are expected to increase by 25% from last year to 34 trillion won this year.

The KOSPI 200 dividende propensity is estimanted to exceed 30% for first time.

In addition, Samsung Electronics' surplus cash ratio continues to increase.

It also announced that more than 50% of FCF would be returned to shareholders for 3 years from 2017.

Samsung Electronics' third-quarter operating profit reached 12.3 trillion won, up 58% from the third quarter of 2019.

It has been confirmed that sales of home appliances have increased due to increased smart phone sales and corona.

Samsung Electronics is one of the few shares in Korea that pay quarterly dividends.

There is also a possibility of additional special dividends this year.

The biggest reason is to cover the inheritance tax of Samsung Electronics Vice Chairman Lee Jae-yong.

Samsung Electronics is also expected to increase its dividend payout, given Samsung C&T's announcement of a 10% increase in dividends and Samsung Life Insurance's third-quarter earnings.

The news of the increase in iPhone sales is also beneficial to Samsung Electronics.

This is because the price of iPhone Mini in Korea is 950,000 won, and the cost is about 410,000 won, and Samsung Electronics' parts are about 110,000 won and 27%.

All the products of Korean OLED companies are exported to Apple through Samsung Electronics.

So What's the Conclusion ?

Samsung Electronics's stock price sontinues to rie as sales continue to increase.

The stock price always shelves all issuese. It's oftentoo lae when we get to know each other.

The good news that hasn't been announced yet must be spreading to the stock market.

Ironically, Apple's market capitalization is over 2,000 trillion won and Samsung Electronics' market capitalization is 450 trillion won.

And now that the 17 year FCF shareholder Return Plan is over, Samsung Electronics is planning to announce the sharegolder return plan at the end of January 2021.

The Korea stock market expects a 20~30% increase in dividends fixed at 354 won per share for two years.

This is because dividend payouts are expected to increase by more than 20% without changing the citeria for allocating 50% of the surplus cash flows.

Samsung Electronics' dividend payout is expected and it is increasingly atrractive to long-term investment like overseas stock.

* all information used for posting was referenced to the reports of Shinhan, Samsung, and KB Securities.

* Please understand that all contents were posted based on facts, but subjective thoughts may be included.

댓글